AvaTrade presents itself as an excellent choice for Australian traders. This broker ensures full compliance with local regulations and offers attractive trading conditions to its clients.

With over 14 years of experience in the market, AvaTrade has emerged as one of the leading companies and consistently ranks among the best Forex brokers. The broker is committed to fulfilling its obligations to customers and regulatory authorities, embracing innovative practices, and constantly striving to enhance its services.

AvaTrade, established in 2006, has gained a strong foothold in the global market with its stringent regulatory compliance. As a trusted and secure trading platform, AvaTrade serves over 200,000 customers worldwide. With a remarkable track record, it has facilitated more than 2 million trades per month, surpassing $1.47 trillion in traded value since its inception.

AvaTrade stands out in the Australian market by offering an impressive range of customizable trading platforms. With five distinct options available, traders of all levels, from beginners to experts, can find a suitable platform to meet their needs.

To provide you with an informed decision, I have conducted a comprehensive AvaTrade review, evaluating factors such as offered assets, fees, customer service, and safety. By comparing AvaTrade to similar brokers such as Pepperstone, I aim to determine its competitive position in the market, ensuring you have the necessary information to assess whether this platform is suitable for you.

Also consider reading my guide to the Best Forex Brokers in Australia

AvaTrade operates under the regulation of seven reputable commissions, including CBI (EU), B.V.I. FSC (British Virgin Islands), ASIC (Australia), FSCA (RSA), FRSA (UAE), FSA, and FFAJ (Japan). To provide greater security for customer funds, the broker employs segregated accounts.

Here are some noteworthy statistics about AvaTrade that may interest traders in Australia:

- AvaTrade offers a wide selection of trading instruments, with over 250 assets available.

- Their customer service team, proficient in 14 languages, is accessible 24 hours a day, five days a week.

- The company holds accreditation from seven regulatory authorities spanning five continents.

- AvaTrade boasts a monthly turnover exceeding 60 billion US dollars.

- With 14 years of experience in the financial services market, AvaTrade has garnered a vast customer base of over 200,000 traders worldwide.

- Over the years, the broker has received nine awards recognizing the quality of services provided.

Who is AvaTrade?

AvaTrade, formerly known as AvaFX, is a renowned brokerage firm with its headquarters situated in Dublin, Ireland. With regional offices established worldwide, AvaTrade aims to empower individuals to invest and trade with confidence in an innovative and trustworthy environment. They pride themselves on delivering exceptional personalized service and unwavering integrity.

In line with their commitment, AvaTrade offers Trading Central, a comprehensive suite of tools that equip traders with trading strategies based on technical analysis. These resources have contributed to establishing AvaTrade as one of the premier forex brokers globally.

Ownership of AvaTrade

AvaTrade was co-founded in 2006 by Emanuel Kronitz and Negev Nosatzki. However, in 2015, the trading platform was acquired by Playtech for a significant sum of $105 million.

AvaTrade Product Range Overview

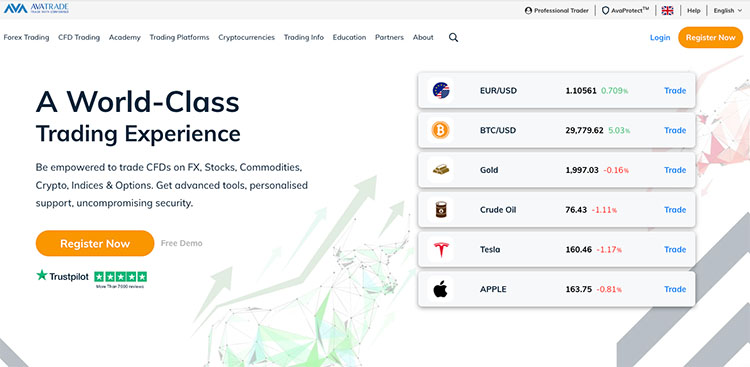

The AvaTrade trading account grants Australian traders access to a diverse selection of more than 250 financial instruments. These include forex trading, CFDs, commodities, cryptocurrency indices, stocks, bonds, vanilla options, ETFs, spread betting, and copy trading.

It is worth noting that AvaTrade does not offer certain asset classes like real stocks, bonds, or mutual funds.

It is important to understand that CFDs are complex instruments that carry a high risk of rapid financial loss due to leverage. 71% of retail investor accounts lose money when trading CFDs with this provider. Before engaging in CFD trading, it is crucial to assess your understanding of how CFDs work and carefully consider whether you can afford to take the high risk of losing your money.

AvaTrade primarily operates as a forex broker, offering 55 major currency pairs for forex trading, which is in line with their main competitors. In addition to forex, they also provide the following:

- 625 stock CFDs

- 32 stock index CFDs

- 59 ETF CFDs

- 27 commodity CFDs

- 2 bond CFDs

This offering is relatively standard within the industry. Traders should be aware that not all trading instruments are available on every platform. Most stock trading is limited to the MT5 platform.

It is vital to familiarize yourself with the risks associated with trading any financial instrument. Currency trading with leverage carries a high risk and may not be suitable for inexperienced investors.

AvaTrade Platform Review

AvaTrade offers a variety of trading platforms suitable for different trading styles and experience levels. With two proprietary platforms, a full MetaTrader suite, ZuluTrade, and DupliTrade, they ensure a comprehensive range of options for traders.

The platform provided by AvaTrade truly stands out, offering an intuitive design that is user-friendly and includes unique order types to minimize potential losses.

Webtrader:

AvaTrade's own web platform, Webtrader, may not offer extensive customization options, but it is well-organized and easily navigable, even for novice traders. The search functions allow traders to search by asset name or category, and basic order types such as Market, Limit, and Stop are available.

For traders concerned about potential losses, AvaTrade offers a form of insurance called AvaProtect. Although this service incurs a fee, it provides reimbursement for any losses sustained during the covered period. AvaProtect is available for market orders.

Webtrader provides charting with 90 indicators, and the platform seamlessly integrates the suite of tools from Trading Central.

However, Webtrader lacks options for setting price alerts or receiving notifications. Additionally, it offers access to around 200 tradable symbols, while MetaTrader 4 provides access to 800 symbols.

MetaTrader 4:

MetaTrader 4 compensates for the customization limitations of Webtrader. It is a third-party trading platform and is globally recognized as the leading platform. Highly customizable, it offers a plethora of features designed to enhance trading performance. Advanced charting functionality and order management tools make position monitoring effortless. While assets are categorized in the search functions, searching by asset name is not possible.

While the web version of MetaTrader 4 lacks alerts and notifications, these features are available on the mobile app and desktop trading platform.

AvaSocial:

AvaSocial is a recent addition to AvaTrade, providing a mobile app that enables traders to follow and chat with other traders, as well as copy their trades. AvaSocial is offered through a third-party provider called Pelican Trading, regulated by the FCA.

Within AvaSocial, traders can discover successful traders to copy, review their trading history, set budgets and limits, and access automated trading. This platform is particularly beneficial for new traders to develop their skills and knowledge.

AvaTrade also offers social trading through two additional third-party providers, DupliTrade and ZuluTrade. ZuluTrade requires a minimum deposit of $500, while DupliTrade requires a minimum deposit of $2,000 to start social trading.

AvaOptions:

AvaOptions is a platform solely dedicated to trading forex options, accessible via desktop and mobile. It is an intuitive platform tailored to suit professional traders with its complexity. While there are no customization options, the search function is excellent, and placing orders is straightforward.

However, it is important to note that AvaOptions lacks any alerts or notifications

AvaTrade Mobile Trading Platform

The mobile trading experience at AvaTrade is characterized by its modern and polished interface, offering a wealth of excellent functionality. Traders have three options for mobile trading apps, including the comprehensive MetaTrader suite, AvaOptions, and AvaTrade's own mobile trading platform called AvaTradeGO.

AvaTradeGO stands out as the flagship mobile trading platform, delivering an intuitive and user-friendly experience. Users will find many familiar tools from the web trading platform, along with additional features for social and copy trading.

The app includes features such as news updates, charting tools with 93 indicators, watchlists, and risk management tools like stop-loss, limit orders, and AvaProtect. It is important to note that AvaTradeGO currently lacks two-step log-in and does not support face ID for authentication. For more information about AvaProtect, please refer to the corresponding section in the Webtrader review within this AvaTrade overview.

AvaTrade Research

AvaTrade provides a range of research tools that offer valuable insights for traders. Along with access to news and live economic calendars, they offer an additional advantage by providing access to trading educational resources on Sharptrader.com.

To enhance research capabilities, AvaTrade partners with Trading Central, a third-party research provider. Trading Central offers trading ideas based on technical analysis, focusing on specific commodities, stock indices, and FX pairs.

The economic calendar grants access to fundamental data, providing valuable insights into historical volatility and trends. AvaTrade's comprehensive charts deserve special mention, as they offer over 90 technical indicators. The news feed is an excellent resource for staying updated on market indicators and can be filtered by asset, accompanied by a sentiment score for each asset. The trend analysis tool utilizes AI software to provide indications of potential asset movements based on technical analysis.

Regular blog posts and videos further contribute to AvaTrade's research offerings, offering valuable insights into technical analysis.

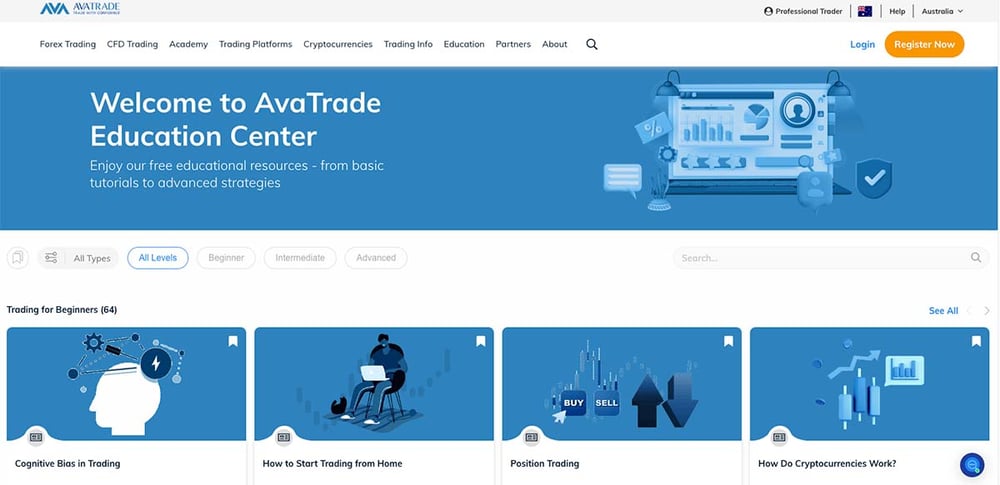

AvaTrade Education

AvaTrade stands out as a leading platform for education, offering an exceptional selection of educational materials along with a free demo account for traders to refine their skills.

The range of educational content available on the AvaTrade platform is extensive. They offer a variety of in-house educational material as well as content from third-party providers like SharpTrader.

Courses and tutorials are conveniently categorized by difficulty and subject, with nearly 60 articles dedicated to beginners and 29 for more advanced traders. Additionally, there are 48 videos available, complementing the tutorials and webinars found on their YouTube channel. The platform also provides eBooks and economic indicators for further educational resources.

Furthermore, AvaTrade offers a free demo account, allowing new traders to explore the platform's features and tools without risking any of their own funds.

AvaTrade Customer Service

AvaTrade excels in customer service, providing prompt and helpful assistance from their courteous and knowledgeable staff, available 24/5 to cater to the opening hours of most markets.

Customers can easily reach AvaTrade's customer service through email, telephone, and live chat. During my experience, I found the live chat function to be particularly impressive, with quick response times and staff readily available to address my inquiries.

While phone support may have slightly longer response times, it remains highly competitive in providing satisfactory assistance. It is worth noting that customer support is offered in a wide range of languages, ensuring effective communication and support for customers from diverse backgrounds.

AvaTrade Account Opening

Opening an account with AvaTrade is a seamless process with no apparent drawbacks. It is quick and easy, allowing you to start trading within minutes, thanks to a low minimum deposit requirement.

The account opening procedure at AvaTrade is highly efficient and entirely digital. To get started, you only need to complete a few straightforward steps, and with a minimum deposit of just $100, you can begin trading.

During the account opening process, you will have the option to select from various account types, including Retail, Corporate, Options, Spread Betting, Islamic, Professional, and Demo accounts. This allows you to choose an account type that suits your trading preferences and requirements.

Moreover, when opening your account, you can choose your preferred base currency from USD, EUR, GBP, CHF, or AUD. Opting for a base currency that matches your trading assets can help you avoid unnecessary currency conversion fees. If trading in the same currency is not feasible, I recommend considering opening a multi-currency bank account to minimize such fees.

To open an account at AvaTrade, simply follow these steps:

- Provide your personal details, such as name and address.

- Answer a few questions about your trading knowledge and experience.

- Upload the required documentation to verify your identity, such as your ID card, driver's license, passport, and a recent utility bill or bank statement.

By following these steps, you can swiftly open an account and embark on your trading journey with AvaTrade.

AvaTrade Safety

When it comes to safety, AvaTrade is a well-established brand that places significant emphasis on regulatory compliance and provides negative balance protection for its clients.

While AvaTrade is not publicly listed and does not disclose financial information, it operates under stringent regulation in multiple countries, ensuring a secure trading environment.

AvaTrade is subject to rigorous oversight by regulatory authorities such as the Central Bank of Ireland, the B.V.I Financial Services Commission, the Australian Securities and Investments Commission (ASIC), the Financial Sector Conduct Authority (FSCA) in South Africa, the Japanese Financial Services Agency (FSA), the Financial Futures Association of Japan (FFAJ), the Abu Dhabi Global Markets Authorities Financial Regulatory Services Authority (ADGM – FSRA), and the Polish Financial Supervision Authority (KNF).

To further enhance the safety of client funds, AvaTrade holds them in segregated accounts, providing an additional layer of protection in the event of any financial issues faced by the platform. Based on my research, AvaTrade has implemented adequate measures to ensure a safe trading environment for its global clientele.

AvaTrade Fees

AvaTrade maintains full transparency when it comes to trading costs. For CFD traders, their offering is competitive, while forex fees fall within the industry average. However, non-trading fees present a mixed picture, with free withdrawals but relatively high inactivity fees.

One aspect I appreciated about AvaTrade is their transparent pricing structure. CFD trading fees are notably low, making them an attractive option for CFD traders. However, in terms of forex trading fees, I found them to be around the industry average, meaning there are cheaper alternatives available if forex trading is your primary focus. AvaTrade provides a convenient forex calculator that allows you to assess the exact cost of your forex positions. The spreads for the popular EUR/USD pair are just below one pip, specifically 0.9 pips, and professional traders may experience even lower spreads of around 0.6 pips.

As for non-trading fees, AvaTrade does not charge any account fees, deposit fees, or withdrawal fees, which is a positive aspect. However, it's important to note the relatively high inactivity fee of $50 per quarter after 3 months of inactivity. If you anticipate engaging in intermittent trading activities, AvaTrade may not be the most cost-effective choice for you. Additionally, an annual administration fee of $100 is applicable after 12 months of inactivity.

Another consideration is the minimum deposit requirement, which stands at $100, aligning with the industry average.

Who is AvaTrade suitable for?

AvaTrade caters to a wide range of traders, making it suitable for individuals at all skill levels. Whether you're a beginner or an experienced trader, AvaTrade offers an extensive selection of trading platforms to meet your needs. Novice investors can benefit from the comprehensive education resources provided by AvaTrade, which are designed to enhance their trading knowledge and skills.

On the other hand, the professional trading platform caters to the needs of more experienced traders, offering advanced features and tools to support their trading strategies. Overall, AvaTrade provides a versatile trading environment suitable for traders at any stage of their trading journey.

AvaTrade FAQs

What is the minimum deposit required to open an account with AvaTrade?

The minimum deposit required to open an account with AvaTrade is $100. This is the industry average and allows traders with different budget sizes to start trading.

Is AvaTrade a regulated broker?

Yes, AvaTrade is a regulated broker. They are licensed and regulated by multiple reputable financial authorities, including the Central Bank of Ireland, the Australian Securities and Investments Commission (ASIC), and the Financial Sector Conduct Authority (FSCA) in South Africa, among others. This regulation ensures that AvaTrade operates in compliance with strict financial and security standards.

What trading platforms are available at AvaTrade?

AvaTrade offers a range of trading platforms to suit different preferences and trading styles. They provide access to the popular MetaTrader 4 platform, which is highly customizable and widely used in the industry. Additionally, AvaTrade has its own proprietary platforms, including AvaTradeGO for mobile trading and Webtrader for web-based trading. These platforms offer intuitive interfaces, advanced charting tools, and various order types to enhance the trading experience.