Anti-aging pill for dogs one step closer to reality as it’s certified ‘effective’ by FDA. What does this mean for your budget?

There’s a famous quote that goes "the only thing ‘wrong’ with dogs is that they can’t live forever." A dog’s lifespan can range anywhere from nine to 15 years on average, and when you consider a dog as part of the family, that’s just not enough time. But what if there was a pill that […]

How to invest in sustainable mining

With the advent of United Nations-driven global net-zero mandates, demand for rare earth minerals is on the rise, and so are investment opportunities in sustainable mining for Canadian investors. Renewable energy is an essential component of phasing out the global reliance on fossil fuels in order to reduce emissions for everyday power consumption needs. However, […]

Bank bundles: Yay or nay, and why?

I love to bundle up. And I’m not talking about adding extra layers of clothing when it’s cold outside. I mean that I enjoy saving money when companies offer bundling bonuses or discounts to customers who get more than one product from the same merchant. It’s an especially popular marketing strategy with telecommunications, software and […]

Tax season is upon us — Looking to fatten your return? Here’s how you can reduce income tax in Canada the proper way

There’s an old adage that goes something like, “What’s the difference between tax reduction and tax evasion? About five years in jail.” As a Canadian, you have the right to reduce the amount of income tax you pay, but what you can’t do is evade taxes. Even rich folks with accounts in Panama can get […]

Canadians want retailers to make it easier to buy homegrown

With the recent surge of national pride following continued threats of tariffs from the US government, a recent survey reveals many Canadians want retailers to make it easier to buy local. According to KPMG in Canada, More than nine in 10 say they want stores to promote Canadian products and think grocery stores should be […]

Mike Myers shows his Canadian pride amid tensions with the US — Here’s how you can too

Hollywood icon and proud Canadian Mike Myers made a bold statement on Saturday Night Live, wearing a T-shirt that read “Canada is Not for Sale.” Myers appeared on the March 1 broadcast of SNL, currently in its 50th season and watched by an audience of over five million people on any given week. His message […]

Warren Buffett calls Trump’s tariffs an “act of war” and warns about the dangers of this hidden tax

Warren Buffett, one of the most respected voices in finance, is known for his straightforward approach to economic policies. So when he recently used the word “war” when discussing tariffs, people took notice. In a recent interview with CBS News, the Berkshire Hathaway chairman called tariffs "an act of war, to some degree." These were […]

Canadians facing cost-of-living and debt fatigue

It’s already tough financially for many Canadians, but with heightened concerns thanks to the looming threat of US tariffs, fatigue is starting to set in. In the Credit Counselling Society’s 2025 Consumer Debt Report, more than half of respondents (54%) – the highest number since the inception of the survey five years ago – report […]

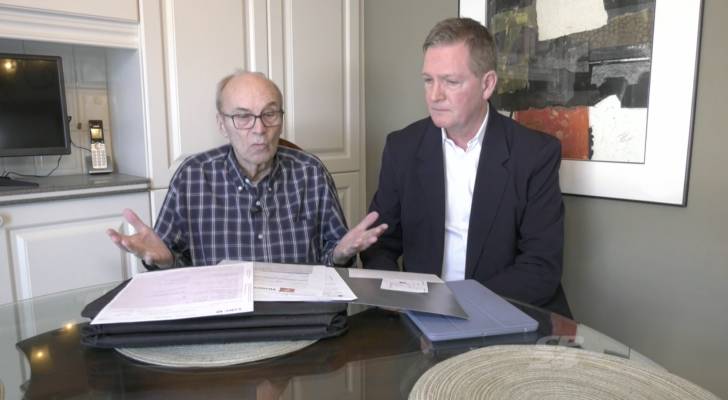

Oakville man loses $750K in sophisticated investment scam — How to spot a scam and protect yourself

An 82-year-old man from Oakville, Ontario, is warning others after he lost $750,000 to an online scam that tricked him into thinking he was making a safe investment. Walter Yamka was searching online for good rates on Guaranteed Investment Certificates (GICs) when he came across a website that looked like it belonged to a trusted […]

Trump’s tariffs come one week before next Bank of Canada rate announcement: What does this mean for Canadians and how can you safeguard your finances?

President Donald Trump’s long-touted 25% tariffs on Canadian goods, as well as 10% tariffs on energy, finally took effect at midnight on March 4, effectively ushering in a fraught economic relationship between the two neighbouring nations and close allies. These tariffs come as the Bank of Canada is poised to make the next prime rate […]