Understanding the biggest sales events of the year: Amazon Prime Day vs Black Friday vs Cyber Monday vs Boxing Day

In today’s retail landscape, specific sale events dominate the shopping calendar. In Canada, the biggest sale days are Boxing Day, Black Friday (and its sister Cyber Monday), along with Amazon Prime Day. Each sales event offers unique opportunities to save on everything from electronics to everyday essentials. For savvy shoppers, understanding the differences between each […]

Small farm, big demand: New Brunswick Wagyu can’t cross borders

Jessica Frenette, owner of Bird’s Hill Farms in New Brunswick, raises full-blood Japanese Wagyu beef that has food lovers across the Maritimes clamouring to buy. But even with eager customers in Nova Scotia, Prince Edward Island and Newfoundland, she cannot sell her product outside New Brunswick. “We are not able to send them our product […]

McDonald’s bets on McVeggie as fast food chains test appetite for plant-based menus in Canada

McDonald’s Canada is adding a new option to its menu: the McVeggie, a crispy vegetarian sandwich made with breaded patty, lettuce, tomato, pickles and sauce. The chain says it’s responding to growing demand for meat-free choices, particularly among younger Canadians. But the move comes with mixed signals from the broader industry. Other fast-food giants have […]

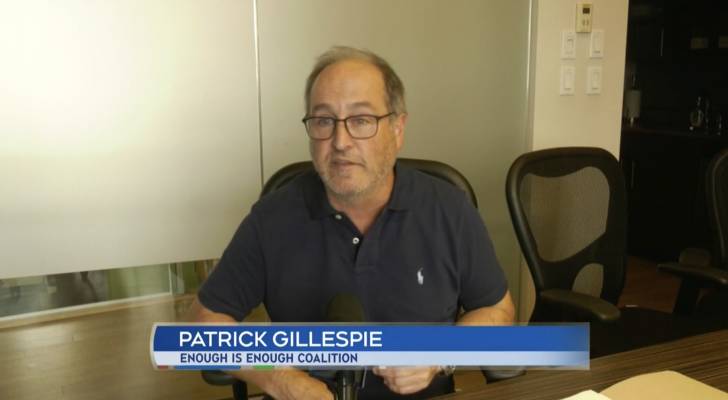

Moncton businesses say crime is hitting their bottom line

Downtown Moncton’s business community is speaking out against what it calls an alarming rise in crime — and the growing financial fallout that’s coming with it. The newly formed Enough is Enough Coalition, made up of business owners, landlords and property managers, is demanding action from all levels of government. In a statement last week, […]

A dozen tips and hacks every Amazon shopper should know

Everyone loves the convenience of online shopping, but Amazon must be doing something special to get this many people to commit to a $99 subscription. As of 2025, about 57% of Canadian adults subscribe to Amazon Prime (1) representing roughly 17 million Canadians. Part of the draw is the convenience. According to Queue-It, a leading […]

“They watched him lose everything”: CIBC, RBC miss $1.7M fraud on B.C. senior

An 89-year-old Victoria man lost nearly $1.7 million to an elaborate “bank investigator” scam that played out over six months — despite clear warning signs that, according to his family, should have prompted action from two of Canada’s largest banks. His daughter, Jill Anholt, said she still can’t understand how both CIBC and RBC allowed […]

Home sales pick up but prices remain stubborn: Royal LePage

Canada’s housing market is showing signs of life in recent weeks, as more buyers begin to make moves, but that renewed activity hasn’t yet translated into widespread price growth. According to the latest Royal LePage Real Estate Services House Price Survey, national home prices were essentially unchanged from this time last year, up just 0.1 […]

“Free” iPhone 17? Why that bank promo might cost you more than you think

Free iPhone 17 just for opening a bank account? Sounds like a no-brainer, right? Canadian banks and fintechs continually roll out flashy promotions to lure in new customers — offering everything from Apple gear to cold hard cash. While these perks are tempting, the fine print can turn that “free” iPhone into a surprisingly expensive […]

Most Canadians aren’t ready for the $1 trillion wealth transfer

As Canada’s population ages, a massive wealth transfer is looming — one experts say many households aren’t ready for. The Great Wealth Transfer, which predicts a staggering $1-trillion reallocation of wealth, has raised concerns about Canadians’ preparedness for what will happen to their estate once they pass away. This concern is not without merit. According […]

Budget 2025 opens the door to growth: How investors and entrepreneurs can turn new tax credits into profit

The 2025 federal budget introduced a series of tax incentives designed to stimulate investment, innovation and productivity — particularly in sectors tied to clean technology, manufacturing and research. While many of these measures aim to strengthen Canada’s long-term competitiveness, they also create new opportunities for investors and small businesses to improve cash flow and lower […]