Tesla protests, saving astronauts, xAI, DOGE — Should you invest in Elon Musk?

Elon Musk is one of the most influential entrepreneurs of our time, with ventures spanning from electric vehicles (EV) and space travel, to artificial intelligence (AI). But recently, Musk stepped into politics, and not every investor is happy about it. Recently, a wave of protests, known as the “Tesla Takedown,” have been targeting Tesla dealerships […]

From $183K to $833K: How Canadians in their 50s bridge the retirement savings gap

Welcome to your 50s! This is your last decade of formal employment — and a time to finalize and fine-tune what retirement will look like. While this process can be exciting, it can also be daunting. That’s because it’s in your 50s when most Canadians start to play “catch-up” on retirement savings. Take, for instance, […]

5 of the best low-risk investments for Canadians that protect your cash — and earn you more in 2025

One of the keys to building wealth is understanding the relationship between risk and reward. Canadians are always on the lookout for low-risk investments, but you must understand that free lunches do not exist. A risk-free investment (like a GIC) has a lower expected return than a high-risk investment (like an individual stock). As an […]

Family of 84-year-old BC widow challenges her will after she left $1m to a ‘male escort.’ Here’s what the family is alleging and what you can learn

After a loved one passes, following their wishes in their will is an important part of caring for your family’s legacy. But, what if they wanted to leave $1 million to a male escort? According to a recently published court ruling, a B.C. widow has done just that — but her family is alleging the […]

Protect up to $800K from inflation: Why Canadians are moving fast on high-interest savings accounts

Knowing where to put your savings can be a struggle. Investing can lead to high returns, but make it harder to access your cash in a pinch. And on the other hand, while your standard savings account is always accessible, interest rates can be low. If you’re looking for low risk, but hoping for some […]

Suze Orman warns most people are ‘dangerously unprepared’ for financial emergencies — here’s how to step back from plunging into debt

We all know we should be saving — putting a little away every pay cheque for a rainy day. But it’s not surprising that many people have very little left to put in a rainy day fund after paying for the every day expenses, such as food, gas and housing. According to a survey by […]

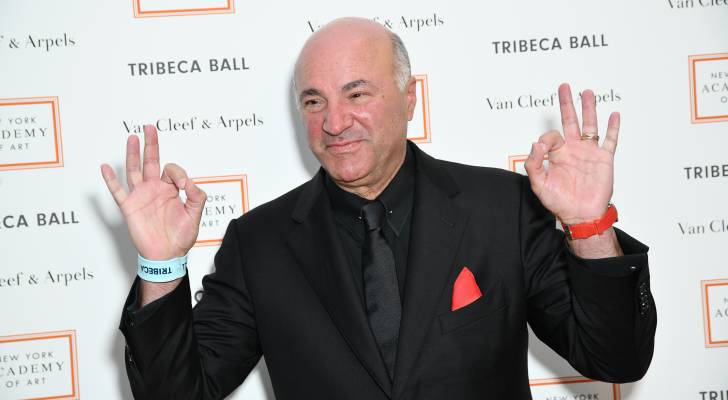

‘All the crypto cowboys are gone’: Kevin O’Leary says the sector is safe now and is backing stablecoins — but experts say it could be ‘sowing seeds of a financial crisis’

Despite financial giants like BlackRock wading into the space, many investors still have trouble taking cryptocurrency seriously. And it’s not just the memes and quirky fans pushing people away. In 2022, about 8% of U.S. adults called cryptocurrency the best long-term investment around. That number has been cut in half ever since the collapse of […]

Think you need to ditch Ben & Jerry’s to ‘Buy Canadian?’ The home of some of your favourite brands may surprise you

Canada is home to many well-known brands and manufacturers, but some of the foods, drinks and clothing brands you may assume are made here actually come from elsewhere – and vice versa. With globalization and corporate acquisitions, the origin of a product isn’t always obvious, even if the brand has strong Canadian ties (or even […]

From city stress to lakeside rest: Budget-friendly ways to own a summer home

Another summer weekend: Scrolling through Instagram, watching friends light bonfires by the lake, paddling into sunsets and relaxing by the lake with an ice cold drink sweating in the summer heat. Images like this might make you wish that you had a Muskoka chair and a summer home of your own. So you convince yourself […]

Scooping up the cost: Chapman’s Ice Cream freezes prices despite ongoing threat of U.S. tariffs

Chapman’s Ice Cream has been a staple in grocers’ freezers for almost a half a century and the Ontario-based creamery has stayed proud of and true to their origins as one of the favourite ice creams of Canadian families. The recent trade war with the U.S. is no exception. In response to U.S. tariffs on […]