This unemployed Texas man pays $1,200/month for his car, has $94,000 in debt. Blames weird ‘dynamic’ with mother-in-law. Dave Ramsey doesn’t buy it

This article adheres to strict editorial standards. Some or all links may be monetized. American households carry $1.66 trillion in auto loan balances collectively as of Q3 2025, according to the Federal Reserve Bank of New York (1). While there may be many different reasons that justify taking on massive auto debt, for Emmanuel from […]

‘I’ll just ask Grandma for money’: Caleb Hammer’s biggest crashout yet shows how financial help can cross into exploitation for struggling families

Financial advice host Caleb Hammer is known for blunt assessments, but a recent episode featuring a 29-year-old unemployed Houston man pushed him to his breaking point. The guest, Jason, racked up more than $60,700 in debt while routinely asking his 73-year-old grandmother for money, including funds that financed a $1,300 trip to Chicago to see […]

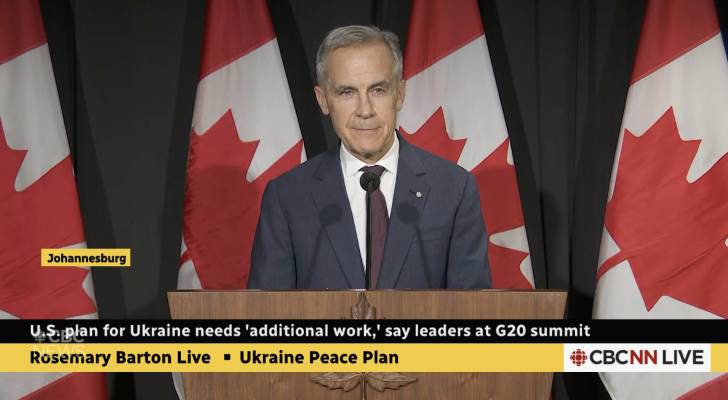

Mark Carney’s “Who cares?” has become a mood: But should you care?

Prime Minister Mark Carney’s off-hand “Who cares?” was delivered with a shrug, but it travelled farther than the Johannesburg press scrum where he said it. Asked when he last spoke to Donald Trump about stalled tariff talks, Carney brushed it off. “Who cares? I mean, it’s a detail. I spoke to him. I’ll speak to […]

I’m 40 and my mother just died, leaving me with a $3.25M inheritance. How do I wisely use this windfall to ensure it’ll last me long term?

CBC News reported in February that the Baby Boomer generation is estimated to leave as much as $1 trillion in assets — cash, investments and real estate — to younger generations between 2023 and 2026, with billions more expected in upcoming decades, creating significant windfalls and challenges for those inheriting these assets (1). Take Rebecca, […]

Experts warn the S&P 500 is broken. Has Warren Buffett’s golden ‘set it and forget it’ rule finally failed?

On October 8, 2025, the S&P 500 (^SPX) reached a record high of US$6,753.72 amid an ongoing government shutdown in the United States (1). For buy-and-hold investors this new high for the S&P 500 may leave them feeling pretty good. But a few market experts are warning that portfolio’s built on holding index funds, like […]

Worried about an impending recession? 10 money moves to make right now

This article adheres to strict editorial standards. Some or all links may be monetized. The chance of a recession hitting the U.S. economy in 2026 is unlikely, according to JP Morgan, but still remains a possibility (1). In 2025, JP Morgan scaled back its recession forecast for the year from 60% to 40% at the […]

‘Pet poverty’ strikes 1 in 7 US pet owners as the average lifetime cost of caring for cats and dogs exceeds $30K — is raising pets only for the rich?

Many Americans know that caring for a pet isn’t cheap, but just how expensive it is can still be surprising to some. A 2025 survey commissioned by MetLife found 1 in 7 (15%) of U.S. pet owners experience “pet poverty,” struggling to pay for both their own basic needs and pet care. (1) Furthermore, 1 […]

Skip university and retire with $4 million: Viral TikTok pitches an aggressive saving plan for teens to end up rich — but is it realistic?

A viral TikTok video from real estate agent and content creator Freddie Smith is making a bold promise: Follow his five-year plan starting in your teens, and you could retire with $4 to $5 million in the bank — all without going to college (1). The plan is built around one key principle: Save and […]

This AI angel investor says 2 red flags instantly tell him not to buy in. Do your investing instincts pass the same test?

Ever wonder why some startups soar while others crash before even taking off? According to Carles Reina, an early backer of AI startup Eleven Labs, two instant dealbreakers will make him walk away. Must Read Real Estate: Thanks to Jeff Bezos, you can now become a landlord for as little as $100 — and no, […]

My parents owe $70K, have almost no assets and plan to ignore the debt until they die. Will I be on the hook to pay it all off?

June’s parents are struggling financially, and she’s not sure how to help. Both are in their 80s and living on Old Age Security (OAS) and Canada Pension (CPP) benefits. They don’t have retirement savings and their assets are slim. Their car is more than 20 years old and they live in a dated park model […]