Bill Gates’ secret that helped make him one the world’s richest men: ‘Save like a pessimist, invest like an optimist’

This article adheres to strict editorial standards. Some or all links may be monetized. Investing in any asset requires some level of risk. But having the right mindset about managing this risk over time is key, given the increased market volatility we’ve seen of late. In order to weather these market storms, Bill Gates and […]

Police used ‘Flock’ cameras to accuse Denver woman of theft — then she had to ‘prove’ own innocence even though she wasn’t there. Here’s how

They say that the camera never lies but, in the case of one Colorado woman, it certainly didn’t get to the truth of the matter either. Chrisanna Elser discovered that the hard way when a police officer showed up on her Denver doorstep on September 27 claiming that video footage from local Flock cameras — […]

Trump administration accused of ‘improperly’ seizing defaulted student loan borrowers’ tax refunds — here’s what it could mean for you

Democratic lawmakers are sounding the alarm on a move by the Trump administration they say has resulted in the government “improperly” seizing the tax refunds of defaulted student loan borrowers. Twenty-three Democratic members of Congress signed a letter addressed to Education Secretary Linda McMahon on Sept. 26, stating the government had failed to provide the […]

‘Highly chaotic’: Ohio couple over $1M in debt, including $56K to the IRS, face a lien on their home. Dave Ramsey offers his sobering take

A couple from Ohio, who up until recently was earning around $230,000 in combined salary, plus revenue from a small side business, finds themselves facing a daunting debt scenario: $628,000 in debt on their house plus other debts totaling $500,000 to $600,000. Larissa, the wife, called into The Ramsey Show seeking advice on tackling the […]

Houston woman says her mother-in-law is holding her family back financially — but Ramsey Show hosts argue her marriage has a way bigger problem

Sometimes money problems aren’t money problems — they’re marriage problems. Sarah from Houston phoned The Ramsey Show because she said her mother-in-law is “holding us back financially.” Her husband’s mom has never been good with money, she added, recalling a period of homelessness after she refused to pay her rent [1]. Must Read Real Estate: […]

Trump Organization wants to crowdfund new luxury Maldives resort built with Saudi partner using digital tokens. Here’s what investors should know

The development of the first Trump-branded hotel in the Maldives will be “tokenized.” This means regular investors will be able to buy digital tokens that represent ownership in it before it is built and participate in what the company is calling “a high-growth, premium real estate project.” Must Read Real Estate: Thanks to Jeff Bezos, […]

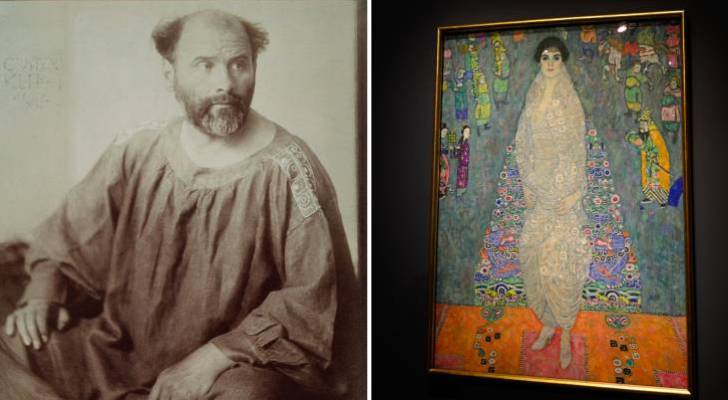

Gustav Klimt artwork stolen by Nazis, nearly wrecked in WWII sells for shocking $236M. Why 2026 sets up great for art investors (and how to cash in)

This article adheres to strict editorial standards. Some or all links may be monetized. Art investing reached new heights recently, when a Gustav Klimt painting set a record as the second-most-expensive painting ever sold at auction. The “Portrait of Elisabeth Lederer” sold in a Sotheby’s auction for $236.4 million (1), beaten only by Leonardo da […]

New Yorkers are driving into debt from MTA toll fees, and 1 resident is crying ‘highway robbery’ after a $35K charge. Here’s the agency’s pithy reply

This article adheres to strict editorial standards. Some or all links may be monetized. Have you ever been charged an excessive toll fee you didn’t understand? Lately, some New Yorkers across the state are going into serious debt thanks to Metropolitan Transit Authority (MTA) fees that suddenly explode with late charges, even when notices are […]

Sandwich generation blues: My wife and I want to pay for our kids’ college, but now her aging parents need help. Can we make it work with $500K saved?

With a recession looming and costs of essentials like housing and food continuing to rise and stay high, many middle-aged Americans are finding that finances are tight not just for themselves, but for their aging parents, too. According to a 2025 survey from LendingTree, almost 1 in 4 Americans (28%) currently give money or help […]

Here are the 5 most mind-blowing money stats of the average American. Learn from them now and build riches in 2026

You can’t manage what you can’t measure, and it’s difficult to measure your personal finances against the rest of the country without the right statistics. You may assume you’re doing great or worse than your neighbors, until you see the actual data. From ballooning car loans to trillions sitting idle in banks, the numbers paint […]