Social Security told Cleveland man, 74, he owed them $1.7K for benefits his wife apparently collected in the months after her death — until it became clear someone else had cashed her checks

When 74-year-old David Carr of Cleveland opened the letter from the Social Security Administration (SSA), he was unprepared for what it said. The SSA told him that his late wife, Deb Carr — who died in March 2020 — had somehow collected $1,700 in unemployment benefits between March and September 2020. He was notified that […]

Wall Street-backed firms are squeezing hopeful homebuyers out of the real estate market in California — and 1 lawmaker says it amounts to ‘housing-crisis profiteering’

A California real estate analyst discovered that thousands of homes in the state are owned by big Wall Street firms. And, in the midst of a housing affordability crisis, the California State Assembly is taking notice. Curious about how many California homes are owned by Texas-based real estate investment trust (REIT) Invitation Homes, Ryan Lundquist […]

‘Grateful to walk away’: 2 houses in this Florida county were recently engulfed in flames caused by popular lithium-ion batteries — but are battery fires covered by insurance?

It started with a lithium-ion battery left charging on a workbench. That single battery caused a raging fire that tore through the Odonnell family’s garage in Spring Hill, Florida. Don’t miss Thanks to Jeff Bezos, you can now become a landlord for as little as $100 — and no, you don’t have to deal with […]

Memphis mom says she had to flee her apartment after the landlord did nothing about her broken A/C for weeks — leaving her bouncing between crashing with family and renting hotel rooms

Memphis can be downright steamy. The average high in June is 89°F, climbing to 92°F in July. In these conditions, air conditioning isn’t just a luxury, it’s a necessity. And not having it could render a home uninhabitable. In the midst of such heat, one Memphis mother and her four-year-old son have been waiting weeks […]

Urgent warning issued for US consumers after ‘security breach’ of 184,000,000 passwords — here’s who’s exposed and how to protect yourself

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. If you’ve been ignoring those pesky "suspicious login" alerts in your inbox, now might be the time to pay attention. Cybersecurity researcher Jeremiah Fowler discovered an unprotected online database […]

How using the Amex Cobalt and the Scotia Passport Visa Infinite cards became the travel credit card combo I swear by

The Amex Cobalt and the Scotia Passport Visa Infinite are two of the best travel credit cards out there, but who says you have to pick just one? As an experienced traveller, I’ll show you how using both can elevate your trips around the world. It may sound like overkill, but trust me, this combo […]

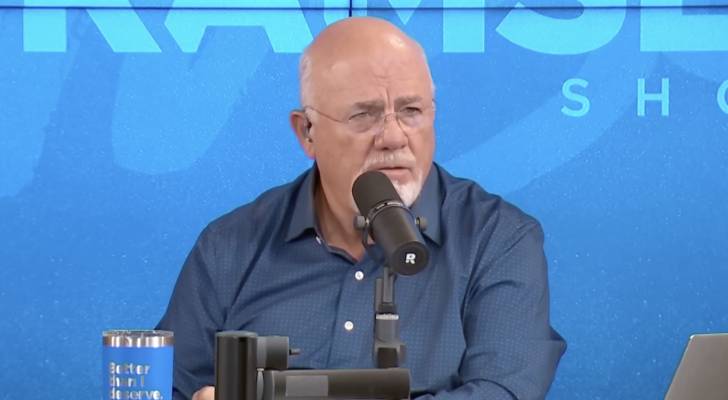

Chicago man’s dream is to run a fishing lodge one day — but he could only scrounge up $100K to fund it. Here’s why Dave Ramsey hears only ‘nightmare’

Small businesses are at the core of the American Dream, but that doesn’t mean every single one of those golden business ideas should become a reality. That’s what finance guru Dave Ramsey said on his show during a conversation with Caleb, a caller from Chicago who wanted advice on getting a down payment to start […]

‘It’s not that hard’: Dave Ramsey tells New York woman who’s mysteriously stuck in a paycheck-to-paycheck cycle despite $300K household income that she’s letting ‘drama’ dictate her life

A school psychologist named Maria called into The Ramsey Show in July with an unusual problem: Despite having minimal debt and a combined yearly income of nearly $300,000, she and her husband could not seem to stick to their budget. Ramsey and co-host Jade Warshaw were visibly frustrated as Maria, who sounded nervous, waffled through […]

I’m 70, have $1 million in my 401(k) and I want to give my son his $200,000 inheritance now to help him buy his first home. But will helping him find his feet set me up for a fall?

Imagine you’re a 70-year-old retiree with around $1 million diligently saved in your 401(k). You’d love to use a portion of these funds to help your adult son buy a house. At first glance, this sounds like a worthy way to pay forward your financial success — a departure from the millions of U.S. boomers […]

‘Quiet cracking’: This dangerous new office condition is the latest troubling trend impacting US workers — and you may not even realize you’re suffering from it

From The Great Resignation to quiet quitting, there’s been no shortage of trends over the past few years that reflect growing dissatisfaction and disengagement in the workplace. The latest is quiet cracking, a phrase coined by TalentLMS, a learning management system company. The term describes a persistent sense of burnout and stagnation that leads to […]