A classic Canadian chocolate bar just got quietly discontinued

If your childhood snack drawer included a Jersey Milk bar, this one might sting. After 75 years on Canadian shelves, Mondelez, the maker behind the confectionary best used for smores, has quietly pulled the plug on the creamy white-wrapped classic, citing low demand. No press release. No farewell tour. Just gone, like the last piece […]

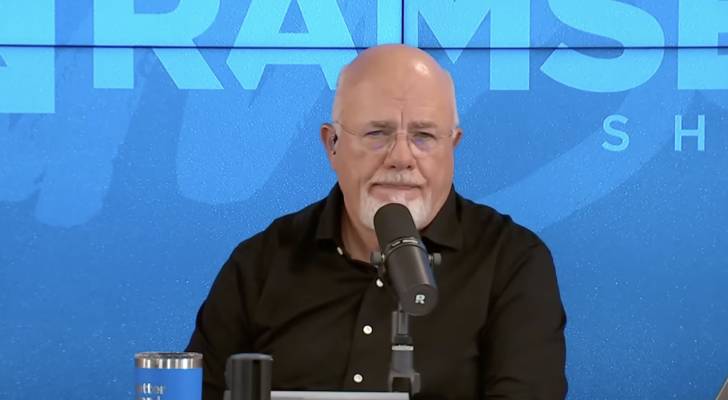

‘I’m leaving it in God’s hands’: NY woman, 55, loaned her boyfriend of 7 years $200K — then he lost it all in crypto and broke up with her. But Dave Ramsey sees a silver lining

Imagine working your whole life, saving diligently, only to see your partner blow $200,000 of your money on a crypto scheme. That’s exactly what happened to one New York caller to The Ramsey Show, who’s now single and left with just $95,000 to her name. Lisa’s question: What now? Don’t miss Thanks to Jeff Bezos, […]

I’m 32 and my single mom stressed over money my whole life. But now that I’ve found some success, she says that I ‘owe’ her for all the sacrifices she made — is she right?

If your parents were to ask you for money, you may feel conflicted or even guilty, but you’re not alone. Take the case of Sam. She grew up in a single-parent household with her mom, who didn’t make a lot of money. Bills were a constant source of stress and watching her mom struggle made […]

North Carolina woman turns to The Ramsey Show after boyfriend of 10 years blindsides her with $80K in secret credit card debt — why they say she can’t make his generosity her guilt

A Raleigh, North Carolina woman was completely blindsided when she found out her boyfriend kept a $80,000 secret from her. In a jaw-dropping call to The Ramsey Show, caller Allie shared that she recently discovered the massive amount of credit card debt her boyfriend of 10 years kept hidden from her. The bombshell didn’t stop […]

I’m 41 years old, been married 10 years, and just found out my husband has been hiding $50K in credit card debt. Can I be held accountable for his money mismanagement?

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. After 10 years of marriage, it can be hard to find new ways to surprise your spouse. But as some couples would tell you, that might not be such […]

50 South Carolina mobile park residents suffering through summer without running water after landlord fails to pay $155K outstanding bill — but the city says its hands are tied

In South Carolina, approximately 50 families living in a mobile home park have no water after the landlord failed to pay a six-figure water bill. The mayor of the town of Andrews told ABC News 4 that the owner of Black River Mobile Home Park, Tim Woodbridge, has failed to pay $155,268.81 in water bills […]

Despite economic uncertainty, Canadian homeowners remain confident in their budget

Despite the daily worries of escalating tariffs, economic recession, inflation and who knows what else, many Canadian homeowners don’t seem all that worried about keeping up. A new CIBC poll found the majority of mortgage holders feeling confident in their ability to handle their mortgage payments and make their budgets work. "As mortgage rates are […]

Forget Florida — these two unexpected states are the new retirement hot spots, offering lower costs, tax perks and a better quality of life for retirees

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. Retirees are flocking to some states in droves. While their motivations aren’t entirely clear, the growing cost of living — especially property taxes — is a likely factor. A […]

I just got the shock of my life after applying for my ‘dream’ New York apartment — apparently, my credit card company has declared me dead. How do I fix this freakish fluke?

Sarah from New York was living her best life. She had secured a new, high-paying job in her industry, and just put in an application for her dream apartment. Everything was looking up until she found out the application had been denied. The reason? She was declared dead. Sarah’s credit card company had mistakenly marked […]

Louisiana woman awarded $4,500 in civil suit after a mechanic dismantled her Volkswagen’s convertible top and returned it boxed up in pieces — how to avoid being taken for a ride

When you take your car in for repairs, you expect it to come back in better shape — not worse. But for Olivia Hayes of Baton Rouge, Louisiana, a simple fix turned into a months-long nightmare. In 2024, Hayes brought her 2010 Volkswagen EOS to a mechanic, hoping to finally repair the convertible top she’d […]