This economist warned the US is ‘past the point where we can fix Social Security by cutting benefits’ — here’s what you need to know before you retire

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. The Social Security system in the United States is in deep trouble. According to the 2024 Trustees report, the Old-Age and Survivors Insurance (OASI) trust fund, which pays benefits…

‘Get out there’: Shark Tank’s Barbara Corcoran said Fed rate cuts would cool mortgage rates, but there’s a downside — here’s why waiting to buy a home might not deliver the win you want

Following the Federal Reserve’s recent 25-basis-point interest rate cut this month, homebuyers may be feeling a renewed sense of optimism. While lower mortgage rates are anticipated, housing prices may not necessarily follow suit. However, Shark Tank’s Barbara Corcoran recently advised on Bloomberg Television that it’s prudent to start house hunting now to avoid increased competition…

What a $500,000 home looks like in every major city

If you’re looking to buy a home in Canada in 2024, you might notice the housing market feels different from recent years. After a period of intense demand and skyrocketing prices, the real estate market is now experiencing a slowdown. Sales have declined in several regions, and prices are starting to ease in some areas,…

Moving to Canada? Here are 4 ways to start building your credit score

If you’re one of the projected 430,000 to 542,000 people who have immigrated to Canada this year, welcome! Aside from acclimating yourself to a new country, home and job, you’ll also quickly realize the benefits of building a credit history with a strong credit score. Whether you’re looking to lease a car or buy a…

Imagine paying 45% more to raise your child—the single tax is real

We are alone but we are many. We are single-income, single parents paying a premium to pay bills and buy necessities for our smaller-sized households. We feel that pinch. Step into a Costco and you’ll know how much cheaper (on a per unit basis) it is to buy bulk. But for many households, like mine,…

From half-pipes to high finance: What investors can learn from Tony Hawk’s unexpected success and smart investments

When you think of Tony Hawk, chances are you picture him pulling off a 900 or flying high in a skatepark. But beyond his legendary skateboarding skills, Tony Hawk’s financial success offers some valuable lessons for investors. Not only did the Hawk conquer the skateboarding world, but along the way he learned a few savvy…

I’m a 47-year-old surgeon, my wife and I make $573,000/year, but we still feel broke — is our financial adviser ripping us off?

Countless Americans are chasing the dream of one day becoming rich. But at some point in the race, many of them come to find there’s an important difference between being rich and feeling rich. Let’s say you’re a surgeon, married, in your late 40s and your household brings in a tidy $573,000 each year. Considering…

Bill Gates once tried to convince Warren Buffett to own a PC — Buffett told him to ‘stick to computers’ and he’ll stick to gum. What you can learn from that exchange to get rich in 2025

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. Many investors are eager to uncover the secret behind Warren Buffett’s remarkable success in identifying winning companies. Between 1964 and 2023, his company, Berkshire Hathaway, achieved an astonishing total…

Bitcoin ETFs see surge in interest after Trump election win drives investors to cryptocurrency

Following Donald Trump’s election victory, financial markets experienced a flurry of trading activity, with investors increasingly turning to Bitcoin as a hedge amid heightened political uncertainty. In Canada, more cautious investors turned to Bitcoin and cryptocurrency exchange-traded funds (ETFs). These ETFs accessibility and security within a regulated environment and, as a result, surged in popularity…

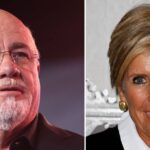

Dave Ramsey told a Ramsey Show caller it’s possible to withdraw at 8% in retirement — but Suze Orman has called even 4% ‘very dangerous’. Who’s right?

The 4% rule in retirement has been a widely accepted retirement standard for over 30 years. Briefly, the rule states that you should draw 4% of your assets from your investments each year in retirement. This should, in theory, allow you to maintain a comfortable standard of living while continuing to let your investments appreciate…