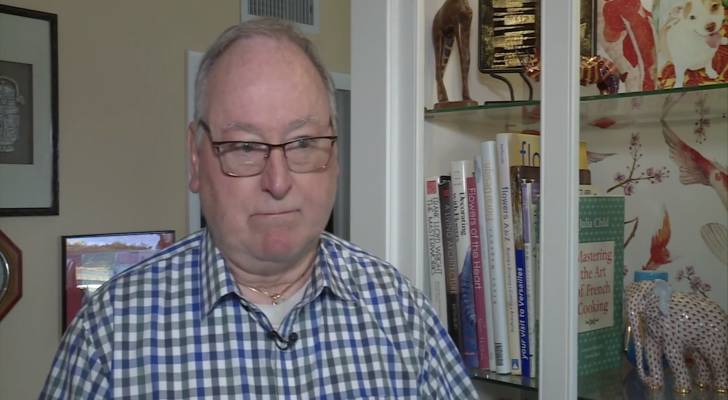

John Klingel lost $38,000, and it all started when he saw a pop-up on his computer.

He told WPTV 5 in West Palm Beach that because the message appeared to be from a cybersecurity company he normally does business with, he was more apt to believe that it was real.

Don’t miss

- I’m 49 years old and have nothing saved for retirement — what should I do? Don’t panic. Here are 5 of the easiest ways you can catch up (and fast)

- Gain potential quarterly income through this $1B private real estate fund — even if you’re not a millionaire. Here’s how to get started with as little as $10

- You’re probably already overpaying for this 1 ‘must-have’ expense — and thanks to Trump’s tariffs, your monthly bill could soar even higher. Here’s how 2 minutes can protect your wallet right now

The thieves then called him and said that someone had taken out a loan in his name to use for gambling and that he could get his name back in good standing by depositing at a Bitcoin Teller Machine (BTM).

“It’s a bitter pill to swallow,” Klingel told reporters.

Here’s how the scam unfolded and how you can spot the signs of fraud.

Cyber thieves are getting more sophisticated

What happened to Klingel isn’t an isolated incident. Jim Shackelford, a Palm Beach County detective, said that because cyber criminals have become so good at exploiting emotions, more people are falling prey to similar scams.

Many may know just enough information about you to lure you in, as with Klingel.

Klingel told reporters that scammers try to pressure you once you get on the phone.

"They tell you to put your money here, scan this QR code here," he says. “You never hear from them [afterwards.]”

Klingel warned that anybody calling who doesn’t know you and wants money is out to scam you. He added that he believes the thieves knew about his relationship with his cybersecurity company due to a possible security breach.

Read more: Want an extra $1,300,000 when you retire? Dave Ramsey says this 7-step plan ‘works every single time’ to kill debt, get rich in America — and that ‘anyone’ can do it

Are there a lot of BTMs in Florida?

As of 2024, there was a network of 2,938 Bitcoin Teller Machines in Florida, with around 30 in the West Palm Beach area alone. The Palm Beach Sheriff’s Office (PBSO) claims there are 187 BTMs in the area and 784 in its southern neighbor, Miami, as of April 2025.

BTM operators claim to offer a more accessible and streamlined way for someone to purchase and sell Bitcoin, but it may also be a place where scams are happening. And if you send money through Bitcoin, it may be hard to trace it or get it back. That’s because the very nature of Bitcoin is meant to ensure a level of anonymity, which could explain why scammers tend to prefer this type of currency.

In some cases, you may be able to get your money back if you report it to the authorities early, but the chances are slim.

How to avoid falling for these types of scams

As the saying goes, an ounce of prevention is worth a pound of cure.

To avoid becoming a victim of a cybercrime, slow down and resist any pressure to make a decision quickly. Ignore any pop-ups you see on your computer, even if they look to be from a legitimate source.

If someone contacts you claiming to be from a financial institution, government or another similar entity demanding payment in cryptocurrency, hang up. None of these organizations will make this request.

Look up the phone number of the company in question and confirm the identity of the person that contacted you, or that you don’t owe any money. For example, if someone from a utility company is asking for payment, call the number found on your bill statement to confirm that you’re not required to pay.

As cyber thieves become more sophisticated, you may fall victim to a scam. There is no shame in that, and you can take steps to try to recover your stolen money.

You can report the crime to your local police department or file a report with the FBI through the Internet Crime Complaint Center. Be sure to include the transaction hash and the cyberthief’s wallet address.

Filing a complaint through your state’s attorney general’s office is also a smart idea.

The Massachusetts attorney general’s office says to avoid hiring third-party cryptocurrency tracing companies to try to get your money back. Many of these may be scammers themselves, using your personal information for their own gain.

Even if not, the tracing company may charge high upfront fees and trace your money using questionable means, or not be able to do anything for you at all.

What to read next

- Millions of Americans now sit on a stunning $35 trillion in home equity — here’s 1 new way to invest in responsible US homeowners while targeting a 14%-17% IRR

- Robert Kiyosaki warns of a ‘Greater Depression’ coming to the US — with millions of Americans going poor. But he says these 2 ‘easy-money’ assets will bring in ‘great wealth’. How to get in now

- Here are 5 ‘must have’ items that Americans (almost) always overpay for — and very quickly regret. How many are hurting you?

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.