Best Sites for Online Roulette in Canada 2025 – Play Online Roulette for Real Money

Lauren Lister, writer, NewsDirect.com | Fact Checked By: Sarah Lunness, NewsDirect.com. Get ready to dive into the exciting world of online Roulette sites! This article takes you on a thrilling journey through online Roulette. Discover the best casino sites in Canada offering roulette with thrilling games, top-notch security, convenient payment options, and amazing bonuses. Prepare […]

Top Real Money Poker Sites in Canada [Updated: January 2025]

Lauren Lister, writer, NewsDirect.com | Fact Checked By: Sarah Lunness, NewsDirect.com One of the most famous forms of online gambling is online poker, offering a fresh and unique experience compared to the in-person game. However, your poker experience will be made or broken by the quality of the poker site you choose to play at. […]

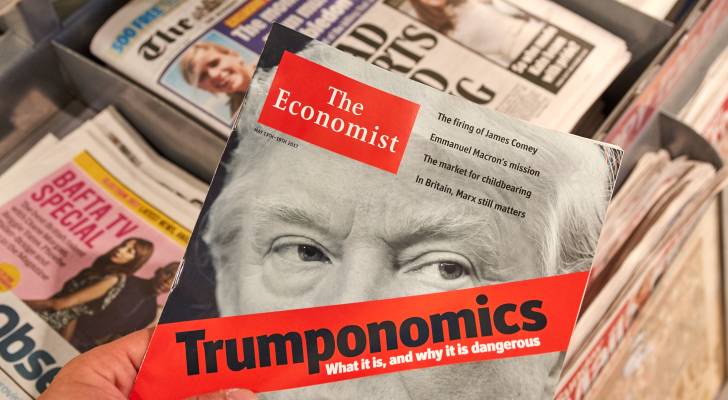

How Trump’s return could crash Canada’s economy: Here’s where to park your cash

Hot off interest rate hikes, Canada’s economic environment remains a potentially volatile and uncertain environment for investors. With risks ranging from fluctuating markets to geopolitical events, experienced investors are increasingly turning to strategic cash holdings — an old-school tactic that helps safeguard your financial portfolios from volatile economic shifts. A cash position offers liquidity, minimizes […]

I’m 58 years old and finally an RRSP millionaire: Do I need a bigger nest egg or can I ease off the gas?

Let’s say a 58-year-old is close to retirement. Not only will he have a decent workplace pension, but they’re finally an RRSP millionaire — a target to which many Canadians aspire. But how far will $1 million take you these days? This near-retiree is wondering if they should keep growing their nest egg or, now […]

GTA housing sales up y-o-y by more than 44% in October 2024: Could 2025 see a surge in activity?

Over the past few years, the prospect of buying a home in the GTA seemed impossible for many, with price tags in the millions and intimidating borrowing rates. That being said, there’s a new sense of ease in the GTA housing market right now as borrowing rates have lowered. For context, last October the Bank […]

Why American fans are saving $1,400 by attending a Taylor Swift concert in Canada

Taylor Swift’s "Eras Tour" captivated audiences worldwide, leading to unprecedented demand and soaring ticket prices, especially in the United States. Interestingly, many American fans discovered that attending a Swift concert in Canada — specifically in cities like Toronto, Ontario, and Vancouver, British Columbia — can be more cost-effective, even when accounting for travel expenses. Here’s […]

What a $500,000 home looks like in every major city

If you’re looking to buy a home in Canada in 2024, you might notice the housing market feels different from recent years. After a period of intense demand and skyrocketing prices, the real estate market is now experiencing a slowdown. Sales have declined in several regions, and prices are starting to ease in some areas, […]

Moving to Canada? Here are 4 ways to start building your credit score

If you’re one of the projected 430,000 to 542,000 people who have immigrated to Canada this year, welcome! Aside from acclimating yourself to a new country, home and job, you’ll also quickly realize the benefits of building a credit history with a strong credit score. Whether you’re looking to lease a car or buy a […]

Imagine paying 45% more to raise your child—the single tax is real

We are alone but we are many. We are single-income, single parents paying a premium to pay bills and buy necessities for our smaller-sized households. We feel that pinch. Step into a Costco and you’ll know how much cheaper (on a per unit basis) it is to buy bulk. But for many households, like mine, […]

From half-pipes to high finance: What investors can learn from Tony Hawk’s unexpected success and smart investments

When you think of Tony Hawk, chances are you picture him pulling off a 900 or flying high in a skatepark. But beyond his legendary skateboarding skills, Tony Hawk’s financial success offers some valuable lessons for investors. Not only did the Hawk conquer the skateboarding world, but along the way he learned a few savvy […]