It’s not uncommon for a marriage to experience financial issues, but sometimes the money problems are just the tip of the iceberg.

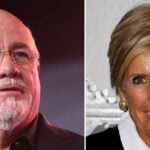

Dave Ramsey recently explained this to a Florida man, Hayden, who called in to the financial guru’s show. Hayden and his wife are deeply in debt, with a US$19,300 balance on their credit cards and US$64,000 in car loans, including a US$37,000 loan for a new Tesla. The two have created a budget to navigate their financial woes, but Hayden’s wife feels the couple hasn’t budgeted for one important part of life: fun.

Hayden shared that in spite of their lavish spending, the couple is struggling to afford things like attending baby showers and dining out with friends. Hayden’s wife, who is pregnant with their second child, has to clear her spending with him, asking for US$50 to use for thesee types of activities, which Hayden routinely denies.

“My wife started to feel very controlled,” Hayden admitted.

As Hayden continued to explain the situation, the conversation quickly shifted from “how do I get my wife on board?” to “how can we make budgeting decisions as a couple?” That’s when Ramsey’s advice veered away from discussing finances.

‘Ultimately, you two probably need marriage counselling’

Ramsey and co-host Jade Warshaw were visibly shocked when Hayden outlined the couple’s debts, as well as the issues Hayden’s wife has with their budget. “You’re imposing this on her, and she’s not got any adult ownership in the sacrifice that needs to occur for you all to swim.”

Since Hayden and his wife don’t appear to be on the same page with their financial goals, Ramsey suggested another remedy that might help the couple get to the bottom of their issues.

“Ultimately, you two probably need marriage counselling,” said Ramsey. “She’s not involved in this at all, emotionally, and so you’ve become her parent and she doesn’t like it when you tell her ‘no.’ And you’re getting tired of being the parent.”

Warshaw also pushed for the couple to attend counseling, noting that for most new parents, the arrival of a child tends to change their relationship with money. If Hayden’s wife still has a desire to spend recklessly, there is likely an underlying factor leading to this behavior.

“My guess is there’s something behind this,” said Warshaw. “You go to counseling, you’re going to figure out what that is, because there is something stopping her from wanting to go all in on this.”

While Ramsey was sympathetic to Hayden’s potential marital issues, he refused to let Hayden off the hook for the terrible financial decisions he and his wife have made. For example, buying a brand new Tesla when Hayden and his wife were already drowning in debt.

“It’s asinine, and you knew it when you did it,” said Ramsey. “But you went along with it, trying to make someone happy by buying them stuff. And it doesn’t work.”

Making money decisions as a couple

Budgeting as a couple should be a joint activity that not only takes into account what’s possible today, but also what’s possible for the future — what retirement will look like, when you both plan to leave the workforce and how you will invest to live comfortably when you reach retirement age.

According to an RBC poll, 77% of couples consider money a source of stress in their lives, and 62% say it causes them arguments.

While money issues are a common theme in marital discord — and even a top predictor of divorce — according to a 2013 study — it is possible to get on the same page about financial goals, even if one partner is a saver and the other is a spender. On the Ramsey blog, Rachel Cruze discusses how couples can get aligned with their money goals.

“When it comes to money fights in marriage, there’s often a surface issue and an underlying issue. And the only way to find the root cause of the argument is to stop and talk about it,” she wrote.

Cruze also detailed that savers and spenders are equally valid in their decisions as long as they’re maintaining a reasonable approach to their budget. “Neither is right or wrong — they’re just different.”

For Hayden and his wife, it’s important for them to discuss money as equals and understand each other’s perspective.

Making money decisions as a couple

When couples approach budgeting without alignment on goals and what they want the future to look like, one person often takes on the role of the ‘manager’ while the other is taking orders, rather than the budget being a joint project for the pair.

Ramsey notes that getting aligned on money is not just about looking at daily and monthly spending, but seeing the big picture: a plan for your marriage that includes financial stability as one piece of a happy life.

“You’ve been talking about ‘what’ way too much, but not ‘why’,” he told Hayden. “And you’ve got to work on that. Then she’s going to have to take an adult position in this relationship where we sacrifice together for the greater good of our overall family.”

Ultimately, Ramsey advocated for much stricter budgeting for the couple, which may include a “beans and rice” diet until they can get rid of their debt. Ramsey also had some blunt advice on what to do about that Tesla.

“You need to sell her car yesterday, it should have never been purchased,” said Ramsey, but his tough-love approach to Hayden’s troubles didn’t end there. “Don’t talk to me about baby showers when you’ve got debt up around your neck and you’ve got a one-year-old. And don’t talk to me about your Instagram life, I couldn’t give a crap less about your Instagram life.”

“That’s me being mean, and forceful, because that’s what I see in your lives,” admitted Ramsey. “You’ve got to want a bright future more than you want a false present.”

Sources

1. RBC: Finances and feelings: Harsh economic realities taking a toll on relationships among Canadian couples – RBC poll (Dec 2024)

2. CTV News: Fighting over money is a top predictor of divorce, study shows

3. Ramsey: How to Talk to Your Spouse About Money by Rachel Cruze (April 24, 2025)

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.